More Funds AvailableThe COVID Economic Injury Disaster Loan (EIDL) and EIDL Advance programs still have billions of dollars available to help small businesses hard hit by the pandemic, including nonprofits. They have also made the application process more simple than when first introduced.

Applications are due Dec. 31 and all applicants should file their applications as soon as possible to allow for processing. Ask your lender or the SBA if you have any questions.

0 Comments

OSHA Emergency Temporary StandardYesterday, an Emergency Temporary Standard was made public concerning vaccination and testing requirements for larger employees.

We understand that not many Idaho nonprofits have 100+ employees. However, please read the NCN summary carefully to discern if your organization needs to comply. Yesterday, President Biden announced his current six-point plan to fight the COVID-19 pandemic. In the plan, two points may impact Idaho’s nonprofits. Vaccinating the UnvaccinatedRequiring All Employers with 100+ Employees to Ensure their Workers are Vaccinated or Tested Weekly (OSHA developing an Emergency Temporary Standard).

Although we were all hoping that the pandemic would be behind us now, the Delta variant is spreading throughout Idaho. Because of this, nonprofits and other businesses are having to make additional decisions about workplace requirements.

We have seen private businesses, healthcare facilities, and schools issue vaccine mandates. Some even have employment termination as a consequence. Below you will find resources to help you navigate these difficult choices.

The nonprofit sector is a wonderful community that puts people first. We know that you all will approach these tough decisions with grace and understanding. As always, thank you so much for all you do for our state! Please reach out if you have any further questions: [email protected] Action Item: Sign On LetterNonprofits need relief and Congress can act to support our sector. Please join the nearly 400 nonprofit organizations from across the county by signing a letter to congressional leaders and the current administration identifying challenges charitable organizations continue to face.

New PPP Open for Two Weeks Starting Wednesday, Feb. 24, businesses with fewer than 20 employees can apply for relief through PPP. After two weeks, this opportunity will then open to those with 20+ employees. You will need to work with your lender to establish funding options. Over the past month we’ve been fielding a number of questions about the COVID vaccine roll out. Below, you will find a list of resources to help you navigate it as an employer and citizen of Idaho.

We’re always here to help. Should you not find information you need, please do not hesitate to reach out to us for additional support. You can reach us via email at [email protected] or through our online help request form. Nonprofits Call on Federal Leaders to Provide COVID Relief Tailored to NonprofitsOn Friday, January 22, a coalition of nonprofit organizations sent an initial letter to federal leaders urging Congress and President Biden to enact a package of solutions tailored to the needs and realities of nonprofits serving the public good. The letter, after highlighting the unique role of charitable nonprofits in providing pandemic relief and economic recovery, urges federal leaders (President Biden, Speaker Pelosi, and Leaders Schumer, McCarthy, and McConnell) to include provisions in the next COVID relief package that accomplish the following:

Content Credit: National Council Of Nonprofits

Possible New Restrictions - Decision at 5:15 pm MT TodayNew COVID-19 Health Order to be Voted on Friday, Dec. 4th @ 5:15pm MT

Central District Health will vote on the proposed order (see below) today, Dec. 4th at 5:15 pm MT. To watch, please follow this link: Live via Youtube. https://www.schatz.senate.gov/imo/media/doc/2020%20Census%20Deadline%20Extensions%20Act%20(1).pdf

What is the goal?

If enacted, what will the bill do?

Why are these extensions important?

How will School Closures or Virtual Learning Impact your Organization?Throughout Idaho, school districts are in the process of deciding what the year will look like for both students and parents. All of these changes and uncertainties can create anxiety for your employees, wondering how they can manage childcare and/or support at home online learning if they are still having to work. We wanted to make sure that we share the changes to the FMLA specifically from the Families First Coronavirus Response Act as it pertains to employee leave related to COVID impacts. The Department of Labor requires certain employers to provide employees with paid sick leave or expanded family and medical leave. Specifically if the employee is ill, has to care for an ill family member, and/or they are unable to work due to school or childcare closures. Click here to read more Nonprofits with fewer than 50 employees may qualify for an exemption from the requirement to provide leave due to school closings or child care unavailability if the leave requirements would jeopardize the viability of the business as a growing concern. Both full time and part time employees are eligible for certain kinds of leave so please be sure you review your policies and ask questions if you are unsure. You may review our internal policy if it’s helpful to you. You can also ask your payroll processor, back office support, or another HR professional in the sector for further guidance if you don’t feel you have the expertise to implement this in your own organization. We strongly encourage our nonprofit friends to dust off your work from home policies (if you’ve returned to the office), review the feasibility of certain employees taking on tasks that can be done from home, and allow for greater flexibility in working hours for employees who need to help care-take or have children at home. If you don’t already have a membership to TechSoup, consider one today. TechSoup is a great resource for nonprofits to purchase technology infrastructure at nonprofit rates to better enable a variety of work situations, including remote. HEROES vs. HEALS ActsYou may have heard about two competing pieces of legislation that have both been introduced at the federal level recently. The first is called the HEROES Act (Health and Economic Recovery Omnibus Emergency Solutions Act) introduced by the U.S. House of Representatives. The second is called the HEALS ACt (Health, Economic Assistance, Liability and Schools Act) that has been introduced by the U.S. Senate. There are both similarities and vast differences in these bills and thankfully our friends at the National Council for Nonprofits have laid them both out in a side by side comparison for better visual understanding of what each is trying to accomplish. Recently we signed on to a community letter that laid out some collective legislative priorities for the more than 4,000 organizations from all 50 states. Those priorities are:

Join us in contacting Congressman Fulcher and Congressman Simpson and asking them to sign on to the new Moulton/Fitzpatrick letter to House leaders calling for inclusion of nonprofit provisions in the next COVID relief package. You can use the following message and social media prompts:

Mask or no Mask: Where do you Stand?The Idaho Nonprofit Center wanted to conduct a short pulse pull to see where you stand on mask wearing. Please take just 30 seconds (at most) to complete this 2 question poll. We appreciate your time and dedication to Idaho! Partial Unemployment Insurance (UI) Act Enacted*Congress passed and the President signed the Protecting Nonprofits from Catastrophic Cash Flow Strain Act (S.4209) yesterday afternoon. The bill overrides the Labor Department requirement that self-insured nonprofits must pay 100% of benefits costs upfront and get reimbursed by their states later. The bill is called a partial UI fix because it only corrects the misinterpretation of the CARES Act by the Department of Labor. “The message to reimbursing employers from this new law is ‘Don’t panic, partial relief has arrived,’” said Tim Delaney, President & CEO of the National Council of Nonprofits. “The new law is just a partial fix to a serious problem, however, because self-insuring nonprofits and governments still must pay 50 percent of unemployment bills. We urge Congress to fix this second half of the problem this month.” *content provided by Montana Nonprofit Association and the National Council for Nonprofits Level Up at Conference Join over 300 nonprofit professionals - from board members to CEOs and everyone in between - at the premier event for Idaho nonprofit leaders as they address critical issues and opportunities in the nonprofit sector.

During the conference, all attendees will have the opportunity to fully participate in their chosen breakout sessions through microphone enabled live Q and As, polls, and text chat features. Also, for those breakout sessions you do not attend live, you will be able to view the recordings after the event has ended. 20+ different topics for just $75! Sign on to Charitable Giving Coalition letter of support for Universal Charitable Giving Pandemic Response Act TODAY! Our friends from the Charitable Giving Coalition are circulating a one-pager supporting inclusion of the Universal Giving Pandemic Response Act (S. 4032, H.R. 7324) in the next COVID relief package.

TAKE ACTION TODAY: Add your organization to the Universal Giving Pandemic Response Act Endorsement List confirming your support for the bill. The deadline to sign on is TODAY, July 28, 2020 If you live in the Panhandle Health District be advised that residents of Kootenai County are now required to wear face coverings. The mandate requires every person in Kootenai County to wear a face covering that completely covers their nose and mouth when they're in a public place and they can't maintain a distance of six feet.

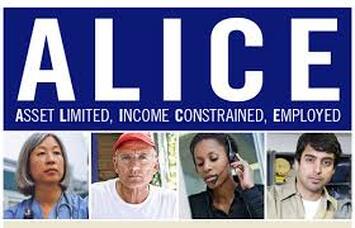

For more information and specifics on the new ordinance, please visit the Panhandle Health District website for more details. Click here to preview the initial draft order. You can also print and display the stop the spread and wear a mask sign that the cities of Coeur d’Alene and Post Falls jointly designed. Many Idaho cities and counties like McCall, Moscow, Ketchum, Hailey, Driggs, Boise and Ada County have adopted similar mask ordinances. Each community wide ordinance has both similarities and nuanced differences. We strongly suggest you review your city, county and/or regional health district website to understand the requirements in your community. Here’s a quick round up of information and guidance that you, our nonprofit friends, can use. COVID-19 Hit as Record Number of ALICE Families Were Priced Out of Survival  When COVID-19 hit, nearly 180,000 households were already one emergency away from financial ruin — a 10-year record high — setting the stage for the unprecedented economic impact of the crisis, according to the state’s latest ALICE Report. Over the last decade, Idaho’s low-income families systematically lost buying power and financial stability as the high cost of essentials outpaced wages, driving the number of ALICE households to rise 86% by 2018, the report shows. To read a copy of the report and find county-by-county and town-level data on the size and demographics of ALICE as well as the community conditions and costs faced by ALICE households, visit www.UnitedForALICE.org/Idaho Provide full unemployment benefit reimbursement to nonprofits that self-insure these benefits.

Federal and state unemployment laws give nonprofits and governments the option of operating as self-insured (“reimbursing”) employers. This means that they reimburse their state unemployment insurance systems for benefits the state paid to the organization's laid off or furloughed employees. Shutdown orders by government officials, program cancellations, and reduced revenue streams have forced many nonprofits to furlough or layoff staff, triggering unemployment payment bills that are due this month in most states. These challenges are adding to cash flow difficulties at a time when funds are needed to deliver on missions, but when other employers will likely experience little or no additional costs resulting from COVID-19-related layoffs. Congress should increase the federal unemployment insurance reimbursement for self-insured (reimbursing) nonprofits to 100% of costs. If you live in the Central District Health Region be advised that residents of Ada County are now required to wear face coverings in indoor and outdoor public places effective immediately. For more information and specifics on the new ordinance, please visit the Central District Health website for more details. Many Idaho cities outside of Ada County (McCall, Moscow, Ketchum, Hailey, and Driggs) saw ordinances go into effect requiring masks as well. Each has both similarities and nuanced differences. We strongly suggest you review your cities website to understand the requirements in your community.

We issued some guidance last week specific to cities with the ordinances in place, and in the coming weeks we anticipate more cities and/or counties following suit. Here’s a quick round up of information and guidance that you, our nonprofit friends, can use. Congress is expected to pass its last piece of COVID-19 legislation this month. It is urgent that nonprofits tell the House and Senate to include nonprofit policy solutions in the final package. Help ensure that federal lawmakers insert these bipartisan solutions in the legislation by signing your organization’s name onto the new Nonprofit Community Letter to congressional leaders. Adapted from the National Council for Nonprofits policy alert 7.6.20 Background InformationThe CARES Act enacted by Congress in March extended economic relief programs to some nonprofits, but the law fell short in many ways. In early April, the broad nonprofit community sent to every House and Senate office a letter highlighting needed policy reforms. That version of the letter was signed by more than 450 national nonprofit organizations.

As your need for virtual events and meetings grow so does the list of services and software. The Boise Metro Chamber of Commerce has complied a comprehensive spread sheet that compares features to help you quickly decide which company is the best fit for your purposes.

We wanted to provide some updates courtesy of the Small Business Administration as well as Rebound Idaho. As we continue to experience instances of community spread in many parts of our state, it’s important that we ensure you are aware of financial assistance available to you.

The SBA began accepting new applications this morning at 7:00 am MDT in response to the Paycheck Protection Program Extension Act. The new deadline to apply for a PPP loan is Aug. 8, 2020. On Wednesday evening the McCall City Council passed a resolution and health order that requires face masks to be worn in all indoor and outdoor public spaces. Click here to visit the city of McCall website for more information.

The order will go into effect at midnight, today July 2. In order for a mask to be effective it must completely cover the nose and mouth. The city maintains that education is the primary goal, but $100 fines are possible for those who do not wish to comply with the resolution. The order affects all areas of McCall and includes an area five miles outside the city limits. To further meet the needs of U.S. small businesses and nonprofits, the U.S. Small Business Administration reopened the Economic Injury Disaster Loan (EIDL) and EIDL Advance program portal to all eligible applicants experiencing economic impacts due to COVID-19 today.

The purpose of this site is to help provide the best reopening information possible and support healthy, sustainable decision-making processes to best serve you, your organization, and your community.

For the most up to date information on navigating workplace reopening during COVID-19, please refer to the following websites: NATIONAL RESOURCES US Centers for Disease Control (CDC) Occupational Safety and Health Administration (OSHA) World Health Organization (WHO) LOCAL RESOURCES RISK MANAGEMENT & LIABILITY

PERSONAL PROTECTION AND SAFEGUARDS

ADDITIONAL RESOURCES

Earlier this week the Idaho Nonprofit Center’s Board of Directors and I issued a statement in support of racial justice and equality. In it we pledged to fiercely and emphatically embrace diversity, equity and inclusion principles as part of our mission and our values as an organization and invited our nonprofit community to join us.

We committed to the following:

I strongly encourage all of you to take a look at this course. Here’s a brief excerpt from the course description for your review: Payroll Protection Program Flexibility ActPayroll Protection Program (PPP) Flexibility Act was signed into law last week. Highlights include:

We received the following information from the SBA this morning and will share their rules and guidance with you as soon as we can. SBA Announcement on Upcoming Procedures as a result of the PPP Flexibility ActSBA, in consultation with Treasury, will promptly issue rules and guidance, a modified borrower application form, and a modified loan forgiveness application implementing these legislative amendments to the PPP. These modifications will implement the following important changes:

Gov. Little to Offer Back-to-Work Cash Bonuses Many nonprofits had reported difficulty in getting employees back to work after being laid off due to the additional $600 unemployment benefit that the CARES Act provided. We have been sharing this information with our state leadership and are pleased to share this news from last week. Nonprofits and small businesses both had the same challenge and our state is working to address it:

Recently, Governor Brad Little announced his plan to offer up to $1,500 cash to Idahoans who return to work. More than 60-percent of Americans who are out of work due to the coronavirus pandemic earn more with the enhanced unemployment benefits than their normal wages. The enhanced benefits are set to expire next month, making it even more important to get Idahoans back to work. “A strong economic rebound cannot occur without workers returning to a job, and the new Return to Work cash bonuses incentivize our workforce to get back to work safely. Like other states, Idaho went from record employment to record unemployment levels in a matter of weeks. Our hearts go out to those who lost jobs or income due to the global pandemic,” Governor Little said. The executive committee of the Idaho Workforce Development Council will discuss the plan next week. Under Governor Little’s plan, up to $100 million in federal relief funds will be made available to Idaho workers who are eligible for unemployment benefits during the coronavirus pandemic. Governor Little’s plan includes one-time cash bonuses of $1,500 for full-time work and $750 for part-time work and will be provided to the worker after return to the workplace. The funds will be available on a first-come, first-served basis for qualified applicants. Governor Little will work with the Idaho Workforce Development Council and his Coronavirus Financial Advisory Committee to finalize the plan and eligibility requirements. More information on eligibility and how to apply for a Return to Work cash bonus are expected to be available by June 15 at Rebound.Idaho.Gov. Idaho was one of the last states with a confirmed coronavirus case and one of the first with a concrete plan in place to open the economy responsibly and safely in stages. Ninety percent of businesses were able to open their doors on May 1, and today nearly all businesses are able to open. NOTE: Cash bonuses are available to anyone who filed a UI claim since March 1 – even those who have already returned to a job since then. It is first come first served. To assist qualified organizations within the state of Idaho in acquiring non-medical/emergency masks, gloves, and sanitizer (MGS), the Idaho Department of Administration is consolidating demand and purchasing large quantities of MGS to distribute throughout the state.

For small businesses and nonprofits that cannot afford the MGS. If you’re one of these organizations, please complete the form and certify that you’re not financially able to purchase the MGS. |

Welcome!We hope you find these resources beneficial. We welcome suggestions on how we can improve this section. Contact us at Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed