|

Why this matters: Bill would create a chilling effect for nonprofits renting public space for events/parades. Organizations would be unable to adequately protect their community and could be priced out due to significant liability insurance increases.

INC position: Advocating Against Senate Bill 1310 was introduced last week by Senator Herndon (District 1) and would require that weapons be allowed to be carried on premises of any public space that is rented or leased, by a private entity and is free/open to the public. Many nonprofits rent public spaces for open, free, public events and do not wish to have weapons for reasons of:

We will continue monitoring this bill and will send out a call for action if this bill has momentum.

0 Comments

Why this matters: This would prohibit state departments from sponsoring non-governmental organizations (i.e., nonprofits) without permission from the governor and would drastically affect our sectors ability to partner with state government.

INC Position: Advocating against. Representative Monks has re-introduced a concept we saw last year that could drastically limit the ways nonprofits are able to partner with state departments. HB463 would prohibit Idaho’s twenty state departments from sponsoring any nonprofit without permission from the Governor. We encourage you to contact your state representatives to share your concerns regarding this bill. To make it as easy as possible, we have a templated letter for you to insert your information and send to your representatives.

Governor's State Address focuses on education and tax relief.Why this matters: Outlines budget and policy priorities for the upcoming year.

On January 8th, Governor Brad Little delivered the 2024 State of the State Address and the FY2025 budget highlights. A few things to note for nonprofits in Idaho:

State Agency Sponsorship Bill Passes the House Why this matters: This would prohibit state agencies from sponsoring non-governmental organizations (i.e., nonprofits) without permission from the governor and would add a misdemeanor charge of misusing public funds for those who don’t abide by the new criteria. HB170, the bill that would prohibit Idaho’s 20 state agencies from sponsoring events, has passed the House and was sent to the Senate. We count on our state agency partners to expand our reach and amplify our missions. Adding extra layers of bureaucracy for state agencies to work with nonprofits would be detrimental to the work we do. Can you help?

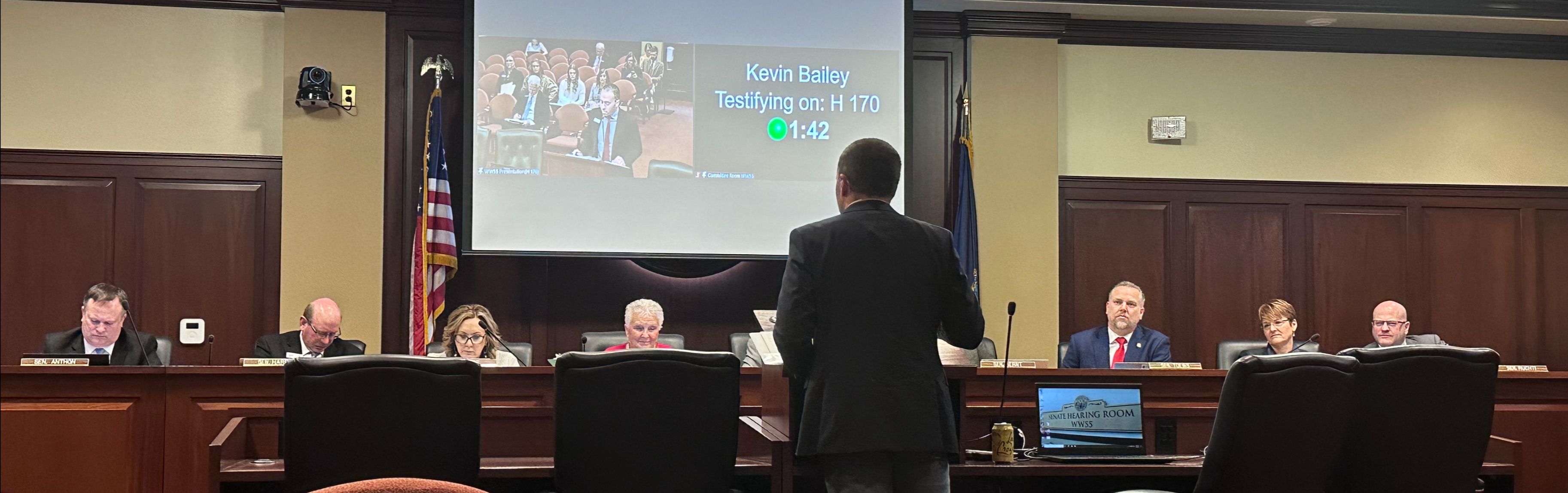

CEO Testified at Senate Committee Meeting Kevin Bailey, CEO of the Idaho Nonprofit Center, spoke against HB170 this morning during the Senate State Affairs committee meeting. The bill is moving forward to a floor vote. However, it will include modifications that allows for more flexibility.  Work still needs to be done to advocate for nonprofit funding and relationships with state agencies so please stay tuned for an upcoming action alert. There will be an opportunity to share your thoughts with your elected officials.  Hospital Property Tax Exemptions At Risk Why this matters: Removing property tax exemptions from nonprofit healthcare institutions is a dangerous precedent that puts our whole sector’s property tax exemptions at risk. H0109 and H0110 are similar bills that limit the property that hospitals can claim as exempt. This type of legislation could encourage healthcare facilities to consolidate into centralized facilities which would further impact the lack of access to care experienced in rural areas of Idaho. Residents of Idaho could also feel the financial impact as the cost would have to shift to consumers, disproportionately affecting low-middle-income Idahoans. Take Action Now: talking points when communicating to elected officials below

Sponsorships from State Agencies at risk for Idaho nonprofits  Why this matters: Financial impact to Idaho Nonprofits We have our first piece of legislation for this session that we are opposing: House Bill 12 (HB12). The proposed legislation would prohibit state agencies from sponsoring non-governmental organizations (i.e., nonprofits) without permission from the governor and would add a misdemeanor charge of misusing public funds for those who don’t abide by the new criteria. HB12 was introduced by Rep. Jason Monks, has been printed and referred to the State Affairs Committee, and has had a fair amount of media coverage. According to the state’s website, Idaho has 180 state agencies that would be impacted by this legislation. Many of those agencies have a purpose that aligns with the goals of nonprofits throughout the state. We count on our state agency partners to expand our reach and amplify our missions. Adding extra layers of bureaucracy for state agencies to work with nonprofits would be detrimental to the work we do. We need you to act.

2023 State of the State address given by Governor 2023 State of the State address given by Governor State of the State On January 9, Governor Brad Little laid out his priorities in the 2023 State of the State and Budget Address. Although many subjects were mentioned, the following will have the most impact on nonprofits:

Recap on the 2022 Session

Action Alert

Happening Now in IdahoBills We Are Taking a Stance On

Advocating Against:

Find your Idaho legislator’s contact info here and let them know how your organization is impacted. Bills We Are Taking a Stance OnAdvocating For:

Federal Updates:Employee Retention Tax Credit Reinstatement Act

HR 6161, the bipartisan House Bill introduced in December 2021, would restore eligibility for the ERTC for the fourth quarter of 2021. This would potentially impact your nonprofit’s bottom line by providing a refundable tax credit. Learn more here. Over 40 national charitable nonprofits have signed the ERTC coalition letter in support of the renewal of this legislation. It is now open for regional organizations to sign. Happening Now in IdahoThe most important legislative items affecting nonprofits in Idaho:

Nonprofits will be Vital to Distributing Federal Funds EfficientlyBy Kevin Bailey, CEO of the Idaho Nonprofit Center. This letter has been co-signed by 22 nonprofit executives from across Idaho listed below. Over the past two – difficult – years, nonprofits have been working overtime to help put dinner on the table, ensure children have winter coats, and help families pay rent. Organizations around the state still have waiting lists to serve people with these vital, immediate needs. Idaho prides itself on private sector solutions and small government and now is the time for local cities, counties, and the state to let nonprofits lead.

Updates on Issues Discussed in the Past Legislative Watch:

Before we jump into 2022, let’s take a look at where we left off in 2021. Below is a brief report on several policy issues from 2021 that impact the nonprofit sector:

OSHA Emergency Temporary StandardYesterday, an Emergency Temporary Standard was made public concerning vaccination and testing requirements for larger employees.

We understand that not many Idaho nonprofits have 100+ employees. However, please read the NCN summary carefully to discern if your organization needs to comply. If you are comfortable, you can contact Senator Crapo to communicate your opinion of the bipartisan Legacy IRA Act.

Background: In 2015, Congress passed the PATH Act, which included the IRA Charitable Rollover provision allowing individuals to make direct tax-free charitable gifts up to $100,000 annually from their IRA starting at age 70 ½. Since its enactment, the IRA Charitable Rollover has generated millions of dollars in new or increased contributions to local and national charities. The Legacy IRA Act builds on that success to expand the existing IRA Charitable Rollover, allowing seniors starting at age 65 to make tax-free IRA rollovers to charities through life-income plans (charitable gift annuity or charitable remainder trust). It is estimated that seniors have up to $5 trillion in IRA assets. This offers a way for middle-income donors to combine charitable gifts with retirement income. It helps existing charities, as seniors typically make up more than half of their donors. An End to Idaho’s Longest Legislative SessionAfter deliberation regarding the pace and efficiency of Idaho’s 2021 Legislative Session, the Idaho Senate has voted to adjourn the longest session in Idaho’s history without an appointed date for resumption, while the House of Representatives voted to recess until the end of the calendar year. Keeping You Updated As things progress, the Idaho Nonprofit Center will keep you updated on any other legislative actions sporadically, both locally and nationally, that have the potential to impact the nonprofit sector.

Updates on Issues Discussed In the Last Legislative WatchPPP Funds running low

Although the Paycheck Protection Program deadline was extended through May 31st, 2021, loan funding is expected to run out in the first week of May. Those who have not yet applied should do so urgently. Updates on Issues Discussed In the Last Legislative Watc Reminder: PPP Extension

On Thursday, March 25th, the Senate passed HR 1799, the PPP Extension Act of 2021, extending the deadline for PPP applications from March 31 to May 31st, 2021. However, funds for the program are being used up quickly, so it is imperative to get to work on your application as soon as possible. Find more information at sba.gov. Updates on Issues Discussed In the Last Legislative WatchIdaho’s COVID Vaccine Distribution Efforts: Beginning April 5th, there will be no prioritization of any group of people in obtaining appointments for vaccination. Read the INC’s guidance on the vaccine in your workplace here. Paycheck Protection Program (PPP) Extension: On Thursday, March 25th, the Senate passed HR 1799, the PPP Extension Act of 2021, extending the deadline for PPP applications from March 31 to May 31st, 2021. Stay on the lookout for further guidance from the SBA. Employee Retention Tax Credit: Your nonprofit may be eligible to receive the ERTC if in 2020, your operations were either fully or partially suspended by a government order limiting commerce, travel, or group meetings due to COVID-19; or your gross receipts were less than 50 percent of those for the same quarter in the previous year. Read the National Council of Nonprofits’ guidance on ERTC here. Federal Updates: Community Navigator Pilot Program As part of The American Rescue Plan Act’s Small Business assistance and support, $100 million has been allocated to establish the Community Navigator pilot program, providing grants to “eligible organizations supporting efforts to improve access to COVID-19 pandemic assistance programs and resources”. Full details of this program have yet to be released. Happening Now in IdahoIdaho Legislature Shut Down Amid COVID-19 Outbreak On Friday, March 19th, the Idaho Legislature voted to move to recess until April 6th amidst several positive COVID-19 tests in both the House and Senate. Until April 6th, all legislative business remains unfinished. American Rescue Plan Act in Idaho On March 18th, Governor Little released further information on the American Rescue Plan Act and its impact on the state of Idaho. Read his comments and plan for Idaho here. Returning to In-Person OperationsThe National Council of Nonprofits is hosting a webinar featuring experts in law, volunteerism, and messaging discussing how to smoothly transition staff and volunteers from remote settings back to in-person operations. The webinar will take place on Friday, April 9th at 3pm ET / 1pm MT. The Idaho Nonprofit Center would like to thank the National Council of Nonprofits for Content Themes.

Urgent Advocacy Action OpportunitiesPPP Extension Act On March 16th, the House passed the PPP Extension Act of 2021, extending the deadline for PPP applications through May 31st. As the bill moves to the Senate, you can help by emailing your Senators, Mike Crapo and Jim Risch, in support of this action. Here is an email template you can use courtesy of the National Council of Nonprofits: "I write to ask you to take immediate action to extend the application deadline for PPP loans. The current deadline expires on March 31, which is much too soon for nonprofits and other small businesses to apply. Last week the House passed a bill, the PPP Extension Act of 2021, with overwhelmingly bipartisan support (415-3) to extend the PPP deadline through May 31. We’re counting on you to help nonprofits and your other constituents so we don’t get shut out of the PPP unfairly." Universal Giving Pandemic Response and Recovery Act The Universal Pandemic Response and Recovery Act (S618 and HR1704) would raise the limitations on the universal charitable deduction from $300 for individuals/$600 for couples to $4,000 for individuals/$8,000 for couples through the 2022 tax year, in addition to eliminating current exclusion of donations to donor advised fund. To support the passage of this legislation, sign-on to the Charitable Giving Coalition’s endorsement form here by Friday, March 26th. Opportunity: White House Briefing on the American Rescue Plan Act and Nonprofits

This Thursday, March 26th, Director of the White House Office of Public Engagement, Cedric Richmond, will hold a briefing with charitable organizations across the nation on what the American Rescue Plan Act means for the missions and operations of our nonprofit organizations. The briefing will be held on Thursday, March 26th via Zoom at 1:00 pm MT / 12:00 pm PT and will be recorded for those unable to attend. |

Welcome!We hope you find these resources beneficial. We welcome suggestions on how we can improve this section. Contact us at Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed